To submit your objection, you will need the following information from your council valuation and rate notice:

- assessment or property number

- site value (value of land)

- capital improved value (value of building(s) and land)

- net annual value – (a minimum of 5% of the capital improved value)

- issue date

The date of valuation is 1 January of the calendar year. An objection submitted through this portal will be checked by the council who issued the rates notice. If deemed valid, it will be forwarded to a valuer for review.

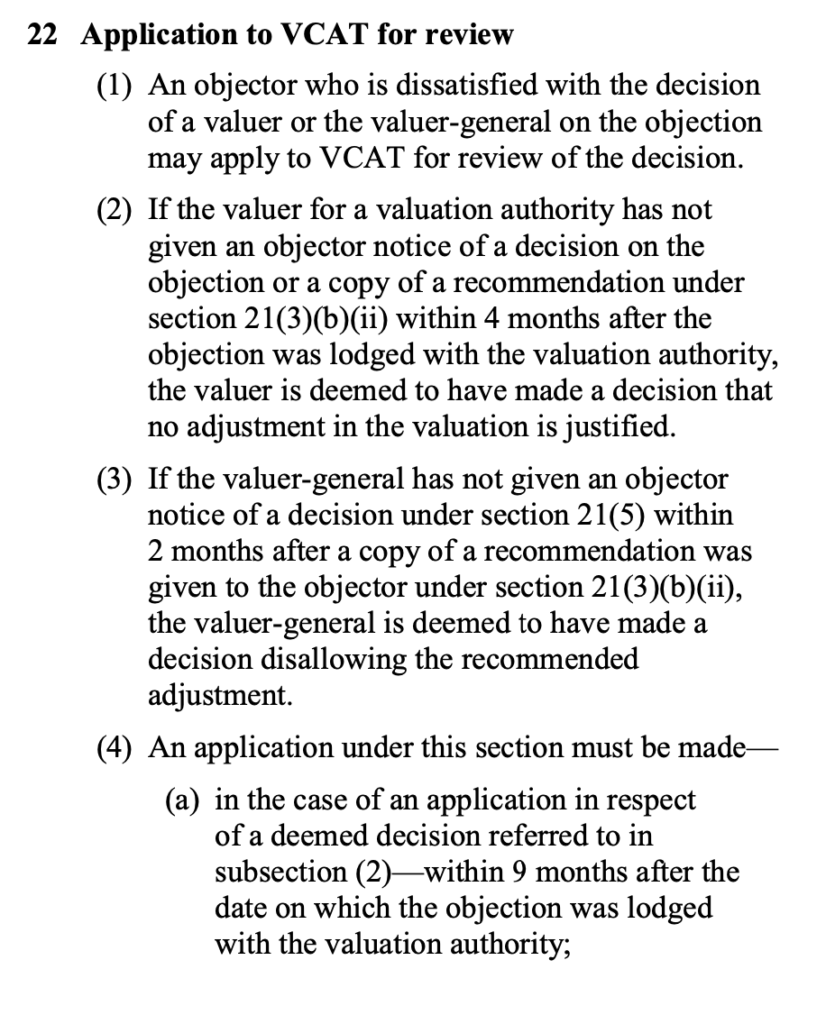

The reasons you can object to the valuation shown on your rates notice are given under Section 17 of the Valuation of Land Act 1960.

An objection must be submitted within 2 months of the notice of valuation being given.

Objection-form-Commercial-Industrial

If you appreciate our work,