When, how and why did Commonwealth Personal Income Tax become compulsory? As a result of the war Personal income tax was transferred from the State to the Commonwealth and when the war ended became the status quo. The introduction of the federal income tax in 1915, was used to fund Australia’s war effort. Between the two World Wars, government expenditure and tax revenues grew significantly and by the beginning of the Second World War, Australia’s tax take was over 11per cent of GDP.

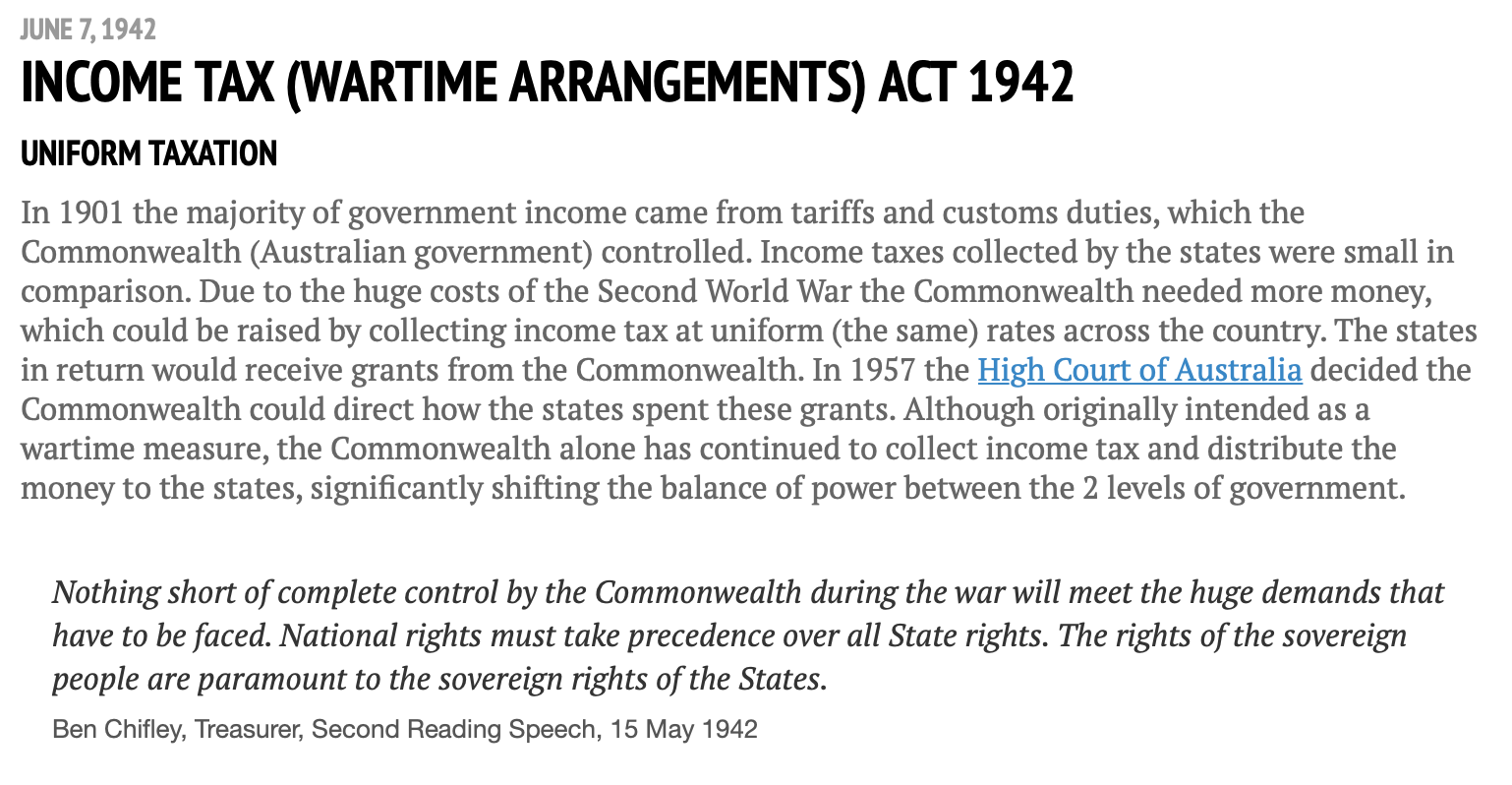

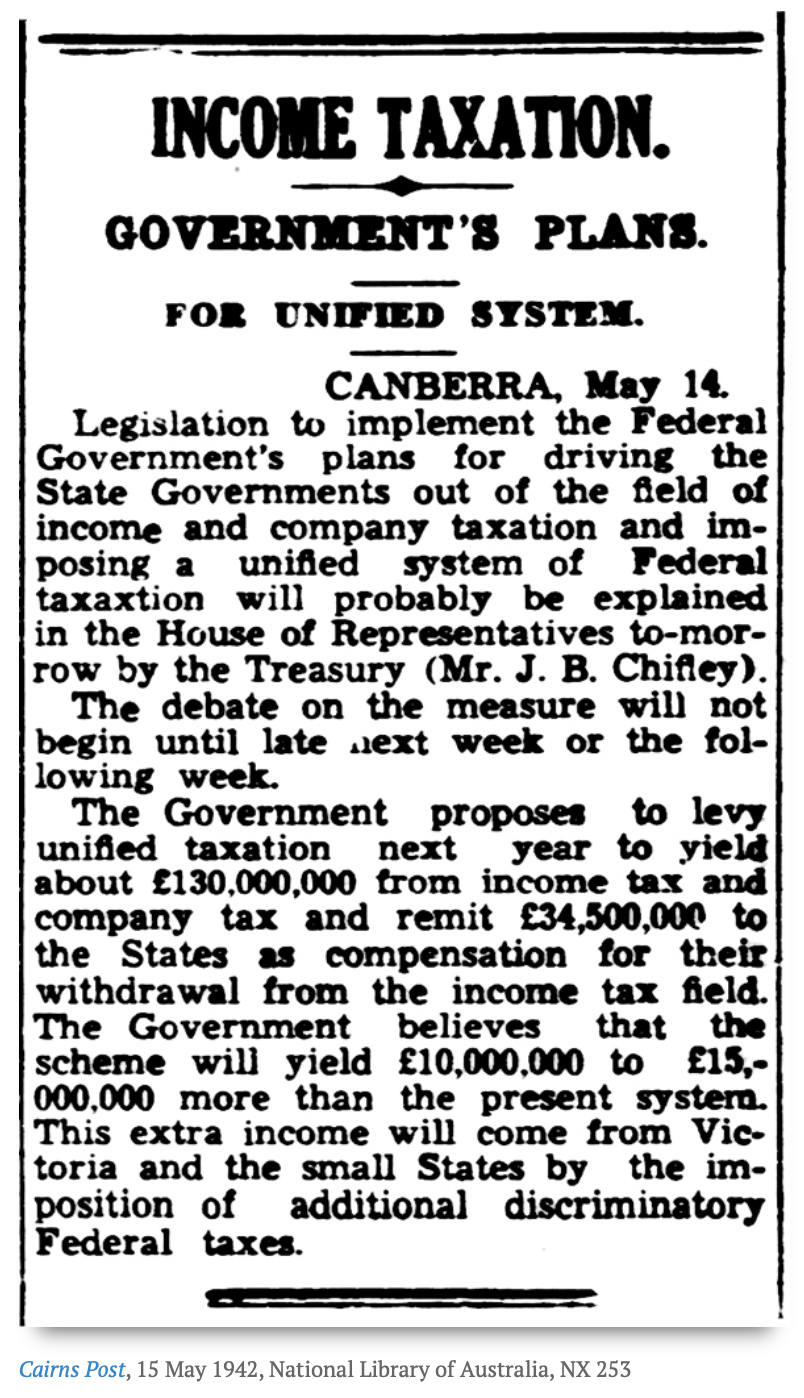

Between 1915 and 1942, income taxes were levied at both the state and federal level, leading to complexity and inequitable taxation of income across states. The Second World War saw fundamental changes to Australia’s taxation system. In 1942, income taxation was consolidated by the federal government to increase revenue as a war-time measure.

By the end of the Second World War, taxation revenue had grown to over 22percent of GDP. The further increase in taxation largely reflected Australia’s involvement in the war and the introduction of government support programmes, such as the widows’ pension in 1942 and unemployment relief in 1944.