DEVALUATION OF A CONSTITUTIONAL GUARANTEE: THE HISTORY OF SECTION 51(xxiiiA) OF THE COMMONWEALTH CONSTITUTION

Danuta Mendelson*

[This article describes constitutional and socio-historical background to the referendum that led to the insertion of s 51(xxiiiA) into the Commonwealth Constitution. It traces judicial interpretations of the clause ‘but not so as to authorise any form of civil conscription’ through the major cases, including British Medical Association v Commonwealth, General Practitioners Society v Commonwealth, and Alexandra Private Geriatric Hospital Pty Ltd v Commonwealth. The issue of the powers of the Commonwealth to regulate private medical practice without infringing the constitutional guarantee against civil conscription is analysed in the context of the development of National Health Care Schemes for financing medical benefits (Health Insurance Commission v Peverill). Constitutional aspects of the 1995 legislation enabling the introduction into Australia of purchaser–provider agreements (‘managed care’) are also examined. Finally, the article questions the constitutionality of the Australian Competition and Consumer Commission’s powers to regulate the essential elements of the patient–doctor relationship.]gjnjjjj

Contents

I Introduction 308

II Constitutional Background 310

III The Origins of the Clause ‘But Not so as to Authorise Any Form of Civil Conscription’ 312

IV British Medical Association v Commonwealth 314

V The Creation of the Medibank and Medicare National Health Care Schemes 318

VI General Practitioners Society v Commonwealth 324

VII Practical and Economic Compulsion 330

VIII The Purchaser–Provider Agreements 331

IX Australian Competition and Consumer Commission 340

-

- I Introduction

Since 1906, 42 Constitution Alteration Bills have been submitted to a referendum, but the Australian people supported only eight of these. Paragraph (xxiiiA) of s 51 was inserted into the Commonwealth Constitution following the successful referendum of 1946. It gave the Federal Parliament power, subject to the Constitution, to make laws with respect to:

The provision of maternity allowances, widows’ pensions, child endowment, unemployment, pharmaceutical, sickness and hospital benefits, medical and dental services (but not so as to authorize any form of civil conscription), benefits to students and family allowances.

Examination of the debates on the Constitution Alteration Bills, case law and legislation relating to s 51(xxiiiA) reveals that a shift in social values and priorities has taken place over the past half century within the Australian community. This shift has affected the constitutional status of the provision. The aim of this article is to provide a jurisprudential history of s 51(xxiiiA) in the context of the shift in values and social priorities. To this end, this article will discuss the constitutional and legal background to the holding of the referendum and the major cases in which the High Court of Australia has determined the meaning of this amendment. For instance, in the case of British Medical Association v Commonwealth, the High Court provided a strict interpretation of the prohibition against civil conscription. However, in General Practitioners Society v Commonwealth, the Court retreated from the strict reading of the prohibition in favour of a reading that gave the Federal Parliament much wider powers of regulation over the medical profession.

In BMA, as well as in General Practitioners, the High Court distinguished between regulation and control of the provision of medical and dental services by the Commonwealth on the one hand, and regulation and control of private medical practice on the other. In order to ascertain whether this distinction applies to the more recently developed models of medical practice, the second part of the article will examine the Medicare system, focusing on the assignment of benefits under the bulk-billing provisions of the Health Insurance Act 1973 (Cth). The bulk-billing model was examined by the High Court in the case of Health Insurance Commission v Peverill, which held that as between the Commonwealth and the person who claims the Medicare benefit, the payout by the Health Insurance Commission constitutes ‘a gratuitous payment’ that does not give rise to a proprietary right to a payment for services rendered, and consequently is outside the definition of ‘property’ for the purposes of the s 51(xxxi) constitutional guarantee that property is only to be acquired by the Commonwealth on ‘just terms’. The third part of the article will analyse the constitutional validity of the 1995 amendments to the Health Insurance Act 1973 (Cth), which have paved the way for the introduction of ‘managed care’ into Australia. The final part will be devoted to issues arising from the enactment of the Australian Competition and Consumer Commission legislation in relation to the constitutional limitations and guarantees contained in s 51(xxiiiA).

It is pertinent at this point to note that in general, constitutional challenges to the validity of Commonwealth legislation involve the consideration of whether or not there is a head of power in the Commonwealth Constitution that would authorise the Commonwealth to enact the legislation in issue. In determining this matter, two further questions have to be asked. Firstly, is the legislation a law with respect to the central area of the head of power and, if not, is the law nevertheless valid as a law that is incidental to the subject matter assigned to the Commonwealth by the Constitution (as distinct from matters incidental to the execution of any power)? The second question — of particular importance in cases relating to s 51(xxiiiA) — is whether the legislation has infringed a limitation (express or implied) on the legislative power of the Commonwealth. Both questions are interrelated, because the High Court tends to be more cautious in applying constitutional limitations to a law that comes within the central area of a Commonwealth power. Consequently, although the article will mainly focus on the second issue of constitutional limitations, the question of legislative power of the Commonwealth will also be discussed.

-

- II Constitutional Background

On 17 September 1900, Queen Victoria proclaimed that on 1 January 1901 the Commonwealth of Australia would come into existence. On that day, the six Australian colonies would become the original States of the federation, united under the Commonwealth of Australia Constitution Act 1900 (UK). The Commonwealth Constitution Act ratified an agreement among self-governing political entities, the old colonies, to give up some of their powers to a new central body — the Commonwealth — while preserving sovereignty over the powers they retained. The Commonwealth could only exercise those powers conferred upon it under the Constitution. All powers not specified in that document, known as ‘residual’ powers, remained with the States. Amongst the powers specifically enumerated in the Constitution (mainly under the paragraphs known as the placita of s 51) were the so-called ‘concurrent powers’, which enabled the Commonwealth to legislate with respect to certain subject matters over which the States also had legislative authority under their residual powers. Thus, under s 51(xxiii) of the Commonwealth Constitution, the Federal Parliament was given powers to legislate for old age and invalid pensions. The responsibility for health care, including the control of the general practice of medicine, was retained by the States under their residual general powers. Likewise, the Commonwealth, under s 51(xiv), was given power to legislate in the area of insurance, other than State insurance, and wide incidental powers were granted to the Commonwealth under s 51(xxxix).

However, the constitutional foundation of measures introduced by Mr Ben Chifley, the then Prime Minister of Australia, was open to challenge on the grounds that the Commonwealth Parliament did not have the power under the Commonwealth Constitution to enact the relevant legislation. The statute in question, the Pharmaceutical Benefits Act 1944 (Cth), provided for specified pharmaceutical benefits to be payable out of the trust account established under the National Welfare Fund Act 1943 (Cth). When enacting the Pharmaceutical Benefits Act, the Commonwealth, being unable to rely upon any of its specific heads of power, relied solely upon the power of appropriation for the expenditure of public moneys under s 81 of the Constitution.

For this reason, a majority of the High Court in the Pharmaceutical Benefits Case held that the Pharmaceutical Benefits Act 1944 (Cth) was invalid. The Court determined that the power under s 81 was limited by s 51(xxiii) to ‘invalid and old-age pensions’, and consequently did not extend to pharmaceutical benefits. In other words, the provision of pharmaceutical benefits was not authorised by the Constitution, and thus fell beyond the powers of the Commonwealth Parliament. The Pharmaceutical Benefits Case placed in doubt the validity of other Commonwealth social services Acts, specifically those providing for maternity allowances, child endowment, widows’ pensions, unemployment and sickness benefits, and hospital benefits. The only way of ensuring the continuance of these benefits was to amend the Constitution through a referendum, as provided for under s 128, to authorise the Federal Parliament to provide such benefits and similar social services.

-

- III The Origins of the Clause ‘But Not so as to Authorise Any Form of Civil Conscription’

In the 1946 referendum, Ben Chifley’s Labor Government placed before the people three separate constitutional Bills. The object of the first Bill was to insert into the Constitution s 51(xxiiiA), which would extend the Commonwealth power in relation to the provision of social services. The second Bill involved granting the Commonwealth powers to legislate for organised marketing of primary products, and the third Bill proposed to give the Commonwealth a new power to make laws on ‘[t]erms and conditions of employment in industry, but not so as to authorize any form of industrial conscription’.

In its proposal for the Constitution Alteration (Social Services) Bill 1946 (Cth), the Labor Government insisted that apart from the power to confer social benefits, the Federal Parliament should also be given power to provide national medical and dental services. The leader of the Opposition, Mr Menzies, supported the extension of the Commonwealth Government’s powers to legislate for the provision of maternity allowances, widows’ pensions, child endowment, unemployment, pharmaceutical, sickness and hospital benefits, but was opposed to the extension of the power over ‘medical and dental services’.

The Opposition argued, with some justification, that the proposed amendment would give the Commonwealth constitutional power to nationalise the medical and dental professions by making all medical practitioners and dentists members of one government service. In fact, by the time the referendum proposals were being debated before the Australian Parliament, medical services had been nationalised in New Zealand. In the United Kingdom, the Labour Government introduced into the House of Commons the National Health and Medical Services Bill 1946 (UK), which led to the creation of the National Health Service Trust. In the House of Representatives, even if Dr Evatt, the then Attorney‑General, was somewhat coy about the issue of nationalisation of medical and dental services, it was made clear during the course of parliamentary debates that some members of the Chifley Government were in favour of introducing a similar scheme for medicine and dentistry in Australia. To prevent this possibility, Mr Menzies proposed an amendment that extended the powers of the Commonwealth to the provision of ‘medical and dental services (but not so as to authorize any form of civil conscription)’. Mr Menzies explained that the notion behind the amendment was, that if ‘the industrial workers were entitled to be protected against conscription, the members of the medical and dental profession should be entitled to similar protection.’ The amendment was accepted by Dr Evatt on behalf of the Government, and the Bill was amended to read

the provision of maternity allowances, widows’ pensions, child endowment, unemployment, pharmaceutical, sickness and hospital benefits, medical and dental services (but not so as to authorize any form of civil conscription), benefits to students and family allowances.

This proposal was put to the people in September 1946, and was carried both nationally and in all six States. While supporting the social services amendment, the Opposition campaigned against the other two Bills, with the result that they failed to gain the requisite support in the majority of States.

It is clear from the referendum debates that Australians, while accepting that social, pharmaceutical, dental and medical benefits provided by the Government were important for the collective good, also recognised the importance of both the right to professional independence held by medical and dental practitioners, and the right to personal autonomy in a doctor–patient relationship. Section 51(xxiiiA) guarded against the possibility of the reduction of these rights by the Federal Government.

-

- IV British Medical Association v Commonwealth

Following the 1946 referendum, the Pharmaceutical Benefits Act 1944 (Cth) was redrafted and re-enacted. Certain sections and regulations of the new Act provided that medical practitioners should write each prescription for a medication listed in the Commonwealth Pharmaceutical Formulary on a government prescription form. Drugs listed in the Commonwealth Pharmaceutical Formulary could be obtained free under the Commonwealth scheme, but the obligation to use the government prescription form was imposed upon medical practitioners whether or not the medicines were to be obtained free. In particular, s 7A(1) imposed a penalty of £50 on any medical practitioner who failed to use a prescription form supplied by the Commonwealth for a medicine, the formula of which was contained in the Formulary, or for any material or appliance, the name of which was contained in the addendum to the Formulary, whether or not these items could be obtained free of charge. The constitutional validity of these provisions was successfully challenged in the High Court of Australia in BMA. The majority declared that the Act was valid, but s 7A was found to be beyond the power of the Commonwealth Parliament and had to be struck down because:

The patient, in the ordinary case to which s 7A applies, employs the doctor and is bound to pay him for his services. The doctor provides the service in return for the payment (or promise of payment) of a fee. The Commonwealth does not provide the service. For this reason s 7A cannot be supported by the provision in s 51(xxiiiA) relating to the provision (that is the provision by the Commonwealth) of ‘medical and dental services’.

Moreover, the requirement of using the government prescription form, irrespective of whether the drugs were being prescribed from the Formulary or not, amounted to a form of civil conscription. Williams J said that whenever medical or dental ‘services are provided whether as services exclusively or in the course of providing some other benefit, the law must not authorize any form of civil conscription of such services.’

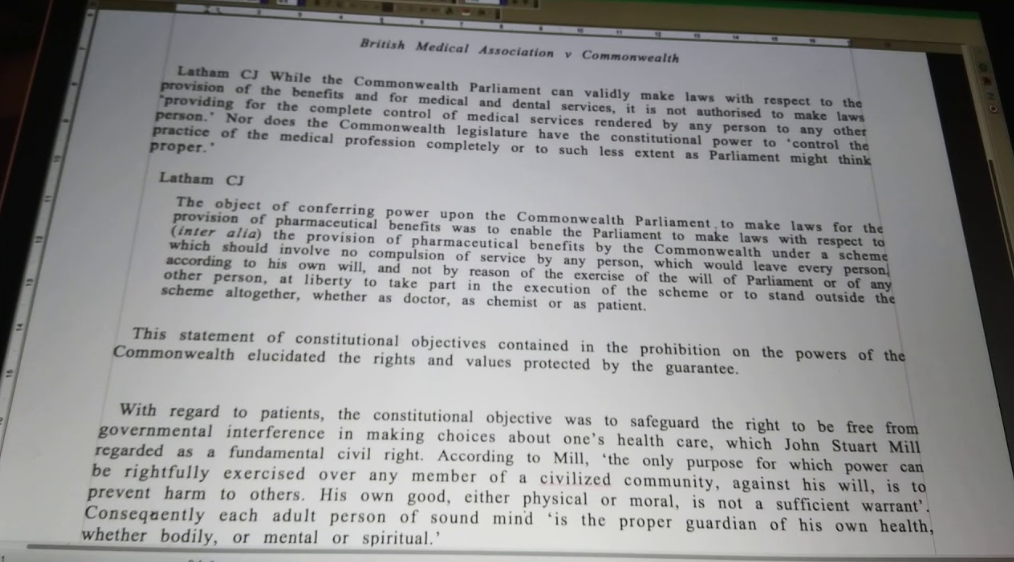

Latham CJ delivered the leading judgment. His Honour first discussed the issue of the nature and scope of the legislative power granted to the Federal Parliament under the amendment. He stated that as a consequence of the introduction of the words ‘the provision of’ at the beginning of s 51(xxiiiA), the new power given to the Commonwealth ‘relates only to provision of medical services by the Commonwealth, and not by … doctors in private practice.’ He defined private medical practice as involving employment by a patient of a doctor who provides the service for which the patient is bound to pay a fee. While the Commonwealth Parliament can validly make laws with respect to the provision of the benefits and for medical and dental services, it is not authorised to make laws ‘providing for the complete control of medical services rendered by any person to any other person.’ Nor does the Commonwealth legislature have the constitutional power to ‘control the practice of the medical profession completely or to such less extent as Parliament might think proper.’

In relation to the issue of the limitation of legislative power embodied in the prohibition, his Honour was particularly concerned with the power of the Commonwealth to control and conscript physicians’ services through economic compulsion. He defined the term ‘civil conscription’ in the following way:

The term ‘civil conscription’ is wider than industrial conscription. It is applicable in the case of any civilian service, ie non-military, work or service. It could properly be applied to any compulsion of law requiring that men should engage in a particular occupation, perform particular work, or perform work in a particular way.

Noting that physicians earn their living by practising medicine, his Honour commented that in determining whether there is compulsion, the court should consider ‘not only the bare legal provision but also the effect of that provision in relation to the class of persons to whom it is applied in the actual economic and other circumstances of that class.’ He alluded to European history before and during World War Two, saying that this experience

has shown that the most successful means of compulsion of services is to be found in the deprivation of means of subsistence. There could in my opinion be no more effective means of compulsion than is to be found in a legal provision that unless a person acts in a particular way he shall not be allowed to earn his living in the way, and possibly in the only way, in which he is qualified to earn a living.

Latham CJ stressed the importance of the words ‘any form’ in the prohibition, and said that ‘[t]hey show that the Parliament intended that any service to which the limitation applied should be completely voluntary and not procured by compulsion of law.’ His Honour discussed the ‘broad purposive construction’ approach to interpretation, which was adopted by the Supreme Court of the United States in its interpretation of the prohibition against slavery and involuntary servitude, contained in the Thirteenth Amendment of the Constitution of the United States of America. Latham CJ applied a similar approach to s 51(xxiiiA) of the Commonwealth Constitution, noting that:

The object of conferring power upon the Commonwealth Parliament to make laws for the provision of pharmaceutical benefits was to enable the Parliament to make laws with respect to (inter alia) the provision of pharmaceutical benefits by the Commonwealth under a scheme which should involve no compulsion of service by any person, which would leave every person, according to his own will, and not by reason of the exercise of the will of Parliament or of any other person, at liberty to take part in the execution of the scheme or to stand outside the scheme altogether, whether as doctor, as chemist or as patient.

This statement of constitutional objectives contained in the prohibition on the powers of the Commonwealth elucidated the rights and values protected by the guarantee. With regard to doctors, dentists and chemists, it emphasised the right to exercise their professional discretion in deciding how to discharge their responsibilities without being compelled to act in a particular way by the government. Notably, Latham CJ observed that under our federal system, the State and Territory Parliaments have the power to enact legislation to control the registration of medical practitioners, and to impose conditions for practice of medicine (including conscription of medical and dental personnel) without infringing the Commonwealth Constitution.

With regard to patients, the constitutional objective was to safeguard the right to be free from governmental interference in making choices about one’s health care, which John Stuart Mill regarded as a fundamental civil right. According to Mill, ‘the only purpose for which power can be rightfully exercised over any member of a civilized community, against his will, is to prevent harm to others. His own good, either physical or moral, is not a sufficient warrant’. Consequently each adult person of sound mind ‘is the proper guardian of his own health, whether bodily, or mental or spiritual.’ The majority’s view that the central area of power under s 51(xxiiiA) concerns the provision of medical and other services by the Commonwealth, not private medical practice, would suggest that the prohibition would apply to Commonwealth laws regulating private practice enacted under other heads of power, not only the amendment.

Dixon J, in dissent, distinguished between the principal power contained in s 51(xxiiiA) and the incidental power. His Honour stated that he was concerned with ‘what is incidental to the subject matter rather than with some matter which arises in or attends the execution of the power of legislation over the subject matter and so would itself be a subject of legislative power under s 51(xxxix).’ He explained that the principal grant of power must include within it not only everything necessary to the effective exercise of that power, but also everything which is incidental to the subject matter of a legislative power. Dixon J then quoted a somewhat obscure statement by Lord Selborne, who observed that laws accompanying the central area of the head of power may encompass

things which are incidental to it, and which may reasonably and properly be done and against which no express prohibition is found, may and ought, prima facie, to follow from the authority for effectuating the main purpose by proper and general means.

The application of these principles of operation of incidental powers to the issue of the constitutional limitation led to the determination that

a wide distinction exists between on the one hand a regulation of the manner in which an incident of medical practice is carried out, if and when it is done, and on the other hand the compulsion to serve medically or to render medical services[.]

The latter is within the prohibition, but the former is not. The regulated incident of practice that is financial and administrative, rather than medical or dental, falls outside the prohibition.

Consequently, according to Dixon J, unlike the compulsion to serve medically or to render medical services, the regulation of the manner in which financial and administrative incidents of medical practice are carried out — such as using government forms for writing out prescriptions — does not infringe the prohibition. Incidentally, his Honour never explained the meaning of the term ‘incident’, which, when applied to private medical practice, denotes events, circumstances, episodes, occurrences and experiences whereby medical, administrative and financial elements are inextricably linked — in other words, the core of clinical practice. The wide Dixonian interpretation of the incidental power contained within s 51(xxiiiA) would be adopted by the High Court in the 1980s.

-

- V The Creation of the Medibank and Medicare National Health Care Schemes

BMA was decided long before the introduction of the national health care scheme, which in turn raised the question about the legal principles that underpin the concept of ‘private practice’ for the purposes of constitutional interpretation. In 1974, the then Labor Government, in reliance upon s 51(xxiiiA) and s 51(xiv) of the Commonwealth Constitution, enacted the Health Insurance Act 1973 (Cth) and the Health Insurance Commission Act 1973 (Cth), which established the original Medibank national health care scheme. The legislation provided for payments by the Commonwealth for medical benefits, hospital services and certain other specific services. Over the years the original scheme has undergone a number of changes. Under the present Medicare system (introduced in 1984), the Health Insurance Commission provides payment of Medicare benefits to patients who incur medical expenses in respect of a professional medical service. This means that 85 per cent of the fees specified in the Medical Services Table of the Medicare Benefits Schedule are being financed out of Consolidated Revenue.

The question arises whether the major constitutional principles relating to the Commonwealth powers (and limitations) to regulate medical practice as established by the High Court in BMA apply to the national benefits scheme. Another issue that needs to be examined is whether the fee for service model of private practice considered in that case is relevant to the model based on the bulk-billing method of payment available under the Medicare scheme, and its more recent permutations. I shall first discuss those aspects of the private practice paradigm that have remained unchanged, and then analyse the High Court’s interpretation of the legal nature of the method of payment known as ‘bulk-billing’. This will be done in the context of cases concerning another constitutional limitation, namely, s 51(xxxi), with respect to the acquisition of property on just terms.

In BMA, Latham CJ defined private medical practice in Australia as a relationship whereby ‘the patient … employs the doctor and is bound to pay him for his services. The doctor provides the service in return for the payment (or promise of payment) of a fee.’ In the 1996 case of Breen v Williams the majority of the High Court agreed that the legal relationship between physician and patient is contractual, in the sense that the medical practitioner performs services in consideration of fees payable by the patient. Within that contractual relationship, the physician has a number of ways of billing the patient. To begin with, contractual arrangements between the medical practitioner and the patient can be negotiated with no reference to the Medicare benefits system. For example, it is established practice in the field of cosmetic surgery to draw up a contract outlining specific cosmetic procedures that the surgeon will perform for an agreed fee payable beforehand.

At the same time, probably the majority of medical practitioners in private practice bill their patients in accordance with the three statutory options provided under the Medicare scheme. The first option allows the private medical practitioner to render the account to the patient directly. Under s 20(1) of the Health Insurance Act 1973 (Cth), a patient who receives an account from a medical practitioner for services rendered can pay the account and then claim and obtain the Medicare benefit from the Consolidated Revenue of the Commonwealth in cash.

Alternatively, by virtue of s 20(2), instead of claiming for and being paid a Medicare benefit, a patient may obtain a cheque payable to the private medical practitioner who has rendered the professional service. The billing practice under s 20(1) and (2) is in harmony with the notion of the traditional contractual relationship — the physician obtains the payment from the patient, and it is irrelevant to the physician that either a part or the whole of the amount due has been claimed by the patient as a benefit from the Medicare account of the Health Insurance Commission, or that the cheque is issued by the Health Insurance Commission rather than by the patient. In each case, the physician will have a private action in debt against a patient who fails to pay the account rendered. Under the third option, pursuant to the provisions of s 20A of the Health Insurance Act 1973 (Cth), the private medical practitioner can bulk-bill the patient. Section 20A(1) allows the patient to assign his or her ‘right to the payment of the Medicare benefit’ to the physician who accepts the assignment ‘in full payment of the medical expenses incurred in respect of the professional service’. Thus, the consideration for the services rendered by the physician is not a payment of money, but an acquisition of a right to a benefit. By virtue of s 20A(3), once the assignment is validly executed, the Medicare benefit will be payable in accordance with the assignment.

Although under the Medicare system of financing medical benefits, the patient retains the right to choose a physician, and the private physician the right to select the method of payment from the patient for the services rendered, there is a major legal difference between the method of billing the patient directly and the ‘bulk-billing’ system. This is because under the latter, the assignee practitioner acquires merely a right to a medical benefit, which is in effect a statutory entitlement to receive payments from Consolidated Revenue. However, the patient’s entitlement to a Medicare benefit is not a proprietary right, but is in the nature of a gratuity in as much as the patient does not provide any consideration to the Commonwealth for these payments. Consequently, when a patient assigns his or her Medicare benefit to the medical practitioner, the assignee practitioner does not acquire any proprietary right which is recognised by general law.

In other words, the fundamental principle that underlies the bulk-billing system is that the payment of a Medicare benefit as between the Commonwealth and the patient is a gratuitous payment. Therefore, the assignment of this gratuitous payment by the patient does not bring the private medical practitioner into a contractual relationship with the Commonwealth. In Peverill, the High Court determined that as between the Commonwealth and the medical practitioner there is no consideration. In that case, Brennan J explained that the s 20A transaction, that is, the agreement to give up a right to payment of a fee for services rendered for a right to claim a Medicare benefit, is between the assignee practitioner and the assignor patient. Under the contractual relationship between the physician and the patient:

Consideration passes from the assignee practitioner to the patient and from the patient to the assignee practitioner. What the assignee practitioner acquires is a statutory right, which, as between the practitioner and the Commonwealth (or the Commission), is a gratuity.

Consequently, as between the Commonwealth and the person who claims the Medicare benefit, the payout by the Health Insurance Commission constitutes ‘a gratuitous payment’ irrespective of whether it is claimed by the assignee doctor or the patient.

Peverill dealt with the way in which the process of assignment under the bulk-billing system changes the nature of rights to which a medical practitioner is entitled for provision of medical services. Dr Peverill operated a number of pathology laboratories in the Northern Territory and Queensland. In the 1980s, Dr Peverill’s laboratories performed hundreds of pathology tests, involving the so-called ELISA test. In 1991 the then Labor Government enacted the Health Insurance (Pathology Services) Amendment Act 1991 (Cth) which reduced, with retrospective effect, the benefit of $34.50 which was previously payable under item 1345 of the Medicare Benefits Schedule for the ELISA test to $17.20. The amending Act was expressed to operate retrospectively from 1 January 1980, which was before Dr Peverill began to provide these tests. Accordingly, the amounts payable to Dr Peverill for the ELISA tests which he performed for patients were reduced retrospectively from $34.50 to $17.20. Dr Peverill sued the Health Insurance Commission, arguing that the retrospective reduction of the benefit under the amending Act amounted to a law with respect to the ‘acquisition of property’ within the meaning of s 51(xxxi) of the Constitution. The majority decided that it did not, because an assignment of medical benefits does not create a proprietary right in favour of a medical practitioner that is recognised by the general law. The Court approached the legislation under constitutional challenge on the premise that it was based on a legitimate economic governmental interest in reducing medical costs. This meant that the interpretation of the relevant provisions was deferential to that interest.

For the purposes of the constitutional guarantee of acquisition of property by the Commonwealth on ‘just terms’, the term ‘property’ is given a very wide definition. It extends not only to a title to or an interest in land recognised at law or in equity but also to ‘every species of valuable right and interest’ such as ‘money and the right to receive a payment of money.’ This includes shares, superannuation entitlements, as well as, for example, a right to bring an action for damages in negligence. However, the right to a medical benefit is excluded from the definition of property for the purposes of the ‘just terms’ constitutional guarantee. One may ask, why?

The answer, provided by Brennan J in Peverill, was that although the scheme created by the Health Insurance Act 1973 (Cth) confers on assignee practitioners a right to be paid Medicare benefits, it does not create a debt vis-à-vis the Commonwealth, and consequently, no proprietary rights arise in the context of assignment. According to Brennan J:

The scheme of that Act [Health Insurance Commission Act 1973 (Cth)] is to appropriate Consolidated Revenue to the extent necessary to allow the Commission, after acceptance of claims made to it within the times prescribed, to pay out to claimants the amounts prescribed by the Principal Act [Health Insurance Act 1973 (Cth)]. The Principal Act confers on assignee practitioners a right to be paid Medicare benefits subject to the conditions prescribed but it does not create a debt.

The right so conferred on assignee practitioners is not property: not only because the right is not assignable (though that is indicative of the incapacity of a third party to assume the right) but, more fundamentally, because a right to receive a benefit to be paid by a statutory authority in discharge of a statutory duty is not susceptible of any form of repetitive or continuing enjoyment and cannot be exchanged for or converted into any kind of property … That is not a right of a proprietary nature, though the money received when the Medicare benefit is paid answers that description.

In view of subsequent legislation which allows the reassignment of bulk-billing assignments, the part of his Honour’s reasoning relating to the incapacity of third parties to assume the right is dated. In their joint judgment, Mason CJ, Deane and Gaudron JJ looked at the issue of ‘acquisition’ for the purposes of s 51(xxxi), and said that the entitlement to a direct payment from a patient for a medical service is ‘a valuable “right” or “interest” of a kind which constitutes “property”’ for the purposes of the ‘just terms’ guarantee. However, when the doctor, through the bulk-billing procedure, exchanges the direct right to be paid by the patient for another, less valuable, statutory right to receive a payment from Consolidated Revenue, the assignment does not necessarily bring about an ‘acquisition’ of the earlier right for the purposes of s 51(xxxi). The joint judgment went on to say that:

Rights of that kind [statutory entitlements] are rights which, as a general rule, are inherently susceptible of variation. That is particularly so in the case of both the nature and quantum of welfare benefits, such as the provision of Medicare benefits in respect of medical services.

In relation to a statutory scheme which involves welfare benefits paid for by public funds, the Commonwealth has to balance not only the competing claims, rights and obligations of patients and physicians, but also the interests of the Commission and the taxpayers. Since

[a]ll these factors are susceptible of change … it is to be expected that the level of benefits will change from time to time. Where such change is effected by a law which operates retrospectively to adjust competing claims or to overcome distortion, anomaly or unintended consequences in the working of the particular scheme, variations in outstanding entitlements to receive payments under the scheme may result. In such a case, what is involved is a variation of a right which is inherently susceptible of variation and the mere fact that a particular variation involves a reduction in entitlement and is retrospective does not convert it into an acquisition of property.

Although the reasoning may appear circular, the decision in Peverill makes it clear that medical practitioners who bulk-bill their patients exchange a proprietary right to a payment which they have earned by providing medical services for a mere expectation of an uncertain gratuity from the Commonwealth. Moreover, bulk-billing medical practitioners have no control over the monetary amount involved in the gratuitous benefit they are hoping to receive from Consolidated Revenue.

It was the concept of the gratuitous benefit that led Gummow J in Breen v Williams to raise a query whether the relationship between patients and bulk-billing doctors could appropriately be described as ‘contractual’. His Honour stated:

The relationship between medical practitioner and patient may engage the law in various respects. Traditionally, there has been a contractual relationship, the medical practitioner performing services in consideration for fees payable by the patient. That established pattern now may require adjustment to accommodate wholly or partly state operated or financed health schemes, established by statute. The ‘bulk-billing’ provisions of the Health Insurance Act 1973 (Cth) … provide an example of this.

His Honour’s point is important, for although at common law the consideration for contract between doctor and patient is the undertaking by the patient to ‘suffer’ treatment, this juristic characterisation of the doctor–patient relationship does not encompass the whole concept of private medical practice. For example, if control by doctors over the fees they charge for their services is considered to be one of the essential elements of the private practice model, then the bulk-billing practitioners may fall outside this model, and hence outside the ambit of the prohibition.

-

- VI General Practitioners Society v Commonwealth

The Commonwealth has the power to interfere legislatively with private medical or dental practice under any number of heads of power enumerated in s 51, provided the law does not infringe the s 51(xxiiiA) prohibition. The question as to whether this was the case in relation to provisions enacted under s 51(xiv) was considered by the High Court of Australia in General Practitioners in 1980. The case was decided at a time when the concept of the welfare state began to be questioned on the grounds of efficiency, with social scientists, health economists and consumer advocates urging the government to contain public health care costs through greater control over the medical profession. Politically, the imposition of such controls was facilitated by the ‘consumer revolution’ of the late 1970s, with its ideology of the world as a global market place populated exclusively by providers and consumers. Members of professions came to be regarded as petty entrepreneurs selling their services to clients just as a used cars salesperson sells cars. Consumer organisations and adherents of economic rationalism, while accusing doctors of enjoying a monopoly and acting in restraint of trade, called for greater regulation of the profession.

The question of the extent to which the Commonwealth Parliament had the power to control financial aspects of private medical practice arose when amendments to the Health Insurance Act 1973 (Cth) were challenged on the basis that they infringed the prohibition against civil conscription contained in s 51(xxiiiA). The amendments imposed special conditions and obligations upon ‘approved’ medical practitioners who provided pathology services in respect of which Commonwealth medical benefits were to be payable. Specifically, the then s 16A imposed a fine of no more than $1,000 upon an approved pathology practitioner who failed to produce ‘a written request or a written confirmation of the request’ for a pathology service from another medical practitioner who had determined that such service was necessary, within 14 days after being served with a notice from an Officer of the Department of Health.

The then s 16B gave the Minister power to draw up forms of undertaking that were to be signed by applicants who wished to become approved pathology practitioners. The undertaking involved a promise to comply with the Health Insurance Act 1973 (Cth), regulations made thereunder, and the Code of Conduct set out in the schedule to the undertaking. It consisted of several clauses. In particular, under clause 9 the practitioner undertook not to ‘render, or request to be rendered’, pathology services, in respect of which medical benefits were payable, that would constitute ‘excessive services’. The phrase ‘excessive services’ was defined as professional services ‘in respect of which medical benefits have become or may become payable, that are not reasonably necessary for the adequate medical care of the patient concerned.’ The object of this prohibition was to regulate clinical decisions of pathologists about the care of their patients. The Code of Conduct contained a number of prohibitions upon the administration and manner of conducting pathology practice.

The then s 16C, inter alia, gave the Minister, acting on behalf of the Commonwealth, the power to accept or refuse to accept the written and signed undertaking. Under the Act, the acceptance of the undertaking by the Minister became an essential requirement for eligible applicants to become approved pathology practitioners. This was because the Act stipulated that patients would only obtain Commonwealth medical benefits if their medical practitioners requested the relevant pathology services from approved pathology practitioners. Since the Commonwealth medical benefits for pathology amounted to 85 per cent of the scheduled fee, and would only be paid to patients of approved pathology practitioners, it was quite clear that those practitioners who elected not to sign the written undertaking, or whose signed undertaking was not accepted by the Minister, would be practically precluded from carrying on or establishing a viable pathology practice.

The High Court of Australia, while affirming the special place of the ‘fee for service’ model of private practice adopted in BMA, adopted Dixon J’s distinction between regulation of the manner in which an incident of medical practice is carried out, and the compulsion to serve medically or to render medical services. On the basis of this distinction, the Court decided that the relevant provisions did not impose upon pathology practitioners an obligation to perform a service, rather, they merely regulated ‘the incidents of [their] medical service’ through administrative procedures. Consequently, the Court held that although the practical effect of ss 16A, B, and C was to compel pathologists to be registered under the Commonwealth scheme, and to comply with the normative standards thereby imposed for the conduct of clinical practice, the law did not amount to civil conscription because there was no legal or practical compulsion on them to perform a medical service.

Gibbs J delivered the leading judgment. His Honour reiterated the principle that there is no explicit head of power under which the Federal Parliament can regulate private medical practice, in the sense of the physician–patient relationship. The Commonwealth’s powers are limited to regulation of those financial and administrative incidents of practice that pertain to provision by the Commonwealth of medical and pharmaceutical benefits. He recognised that amendments to the Act, which made the Commonwealth medical benefits payable only for services rendered by ‘approved pathology practitioners’, meant that the specialist medical practitioners who wished to establish, or continue in the practice of rendering pathology services had no real choice — they had to become ‘approved pathology practitioners’. In so doing, they had to submit themselves to obligations and sanctions cast upon them by virtue of ss 16A, B and C of the Act, its Regulations, and the undertaking. However, although the legislation had the practical effect of compelling pathologists to be registered under the Commonwealth scheme and to abide by the obligations thereby imposed, it would apply only if they wished their patients to be eligible for Medicare benefits. Consequently, the legislation did not impose ‘any form of civil conscription’, as defined by his Honour.

Gibbs J was critical of the wide interpretation of the civil conscription prohibition clause provided by Latham CJ, Webb and Williams JJ in BMA. Specifically, he disagreed with the notion that without strong restraints, Parliament would be able to legislate so as to bring about a complete control of medical and dental practices. His Honour opined that:

No doubt their Honours had in mind the principle of interpretation under which a statutory provision, if ambiguous, may be construed so as to avoid inconvenience and injustice. However, it would seem to me impermissible to give to the words of a constitutional prohibition a meaning wider than that which they naturally convey out of an apprehension that the legislative powers, if not heavily fettered, might be used to effect a wide control of professional activities.

Gibbs J posited the following interpretation of the prohibition clause ‘but not so as to authorize any form of civil conscription’:

There is nothing in the Constitution that would indicate that the expression ‘any form of civil conscription’ where it appears in s 51(xxiiiA) should be given an enlarged meaning which its words do not naturally bear. The words ‘any form of’ do not, in my opinion, extend the meaning of ‘conscription’, and that word connotes compulsion to serve rather than regulation of the manner in which a service is performed.

It is of note that both Mr Menzies and Dr Evatt, who drafted the compromise amendment which resulted in the insertion of the prohibition clause into the Constitution Alteration Bill 1946 (Cth), were known for their precise and erudite use of the English language. The amendment could have simply read: ‘but not so as to authorize civil conscription’, yet they decided to add the qualifier ‘any form of’ to ‘civil conscription’ to which the prohibition applies. At the very least, the adverb ‘any’ (the meaning of which includes ‘in any manner or way’, ‘to an indefinite extent’, ‘at all’, ‘in any degree’) emphasises the width of the forms of civil conscription to which the prohibition applies. However, Gibbs J, having concluded that the adjectival phrase ‘any form of’ was not intended to extend the meaning of ‘civil conscription’, limited the meaning of the term by adding that it did not include a prohibition on the regulation of the manner in which services are to be performed. His Honour did so without explaining either the reason for the presence of the phrase ‘any form of’ in the context of the prohibition, or what this qualifier is supposed to qualify.

In his judgment, Gibbs J defined the phrase ‘civil conscription’ as denoting ‘the calling up of persons for compulsory service other than military service.’ He argued that the term civil conscription encompassed any compulsion of law requiring that physicians should engage in a particular occupation, or perform particular work. However, this term does not extend to the requirement by the Commonwealth that they perform work in a particular way, if that requirement is merely incidental to, and intends to regulate the manner in which administrative and financial incidents of their medical practice are carried out, and did not oblige the physicians to perform a medical service.

This narrow reading of the prohibition clause, together with the wide Dixonian interpretation of incidental powers, has enabled the Commonwealth to exercise quite comprehensive controls over dental and medical professional practice in the context of implementing its Medicare program, without apparently infringing s 51(xxiiiA).

The High Court followed the same interpretive approach to incidental powers in s 51(xxiiiA) in the case of Alexandra Private Geriatric Hospital Pty Ltd v Commonwealth. The Court held that provisions of the National Health Act 1953 (Cth), which created a system of controls over the location, number of beds, level of fees, selection of patients, auditing of accounts, and inspection of approved private nursing homes, were substantially connected with the subject matter (provision of hospital and sickness benefits to residents of those homes) conferred on the Commonwealth under s 51(xxiiiA).

In their joint judgment, Mason ACJ, Wilson, Brennan, Deane and Dawson JJ observed that:

It may be that the degree and nature of the controls imposed on proprietors seriously affect their freedom to run their business as they wish. It might be argued that those controls are more stringent than are strictly necessary to achieve the objectives of the legislation and in some instances, even the economic viability of a home may be threatened. But it is not for the Court to determine that argument or to pass [judgment] upon the wisdom or the suitability of the particular scheme that the legislature has chosen to institute, so long as the Court is unable to say that it lacks a sufficient connexion to the head of power.

The Court’s admission in Alexandra that the controls found to be incidental to the head of power were more stringent than was ‘strictly necessary to achieve the objectives of the legislation and in some instances, even [threatened] the economic viability of a [nursing] home’ suggests that the judges were unwilling to apply either the purposive approach or the proportionality principle of constitutional interpretation to limit the scope of incidental powers.

In retrospect, it appears that the concerns of the majority in BMA, criticised by Gibbs J in General Practitioners, were well-founded. Once restraints imposed by the Constitution upon the legislative powers of the Commonwealth are attenuated through wide judicial interpretation of incidental powers, it becomes difficult for the courts to confine these amorphous powers so as to restrain the Commonwealth from going too far in a coercive direction.

This is not to argue that private practitioners who rely on Medicare benefits should be free from all regulation and control. Rather, at issue is the balance, that lay at the core of the s 51(xxiiiA) amendment, between the values of economic efficiency, and accountability, which inform the regulatory regimes imposed by the Commonwealth and the values of professional autonomy and ethical obligations that lie at the core of clinical practice.

-

- VII Practical and Economic Compulsion

Since Alexandra involved the provision of benefits for private nursing care homes rather than medical or dental services, the issue of the bracketed clause prohibiting civil conscription did not arise. Nonetheless, the High Court stated that it regarded as ‘settled’ the notion that although the prohibition contained in the words ‘but not so as to authorize any form of civil conscription’ in s 51(xxiiiA) applies only to the provision of medical and dental services, the words of the prohibition

are not irrelevant to the scope of the other matters described in the paragraph at least to the extent that whenever medical or dental services are provided pursuant to a law with respect to the provision of some other benefit, for example, sickness or hospital benefits must not authorize any form of civil conscription of such services.

In General Practitioners, Gibbs J mentioned, but did not discuss, the question of whether practical and economic compulsion could amount to civil conscription. Barwick CJ, however, agreed with Latham CJ’s statement in BMA that ‘civil conscription could result from practical or economic considerations.’ At the same time, Barwick CJ considered that in the absence of explicit legal compulsion, the force of circumstances would need to be so strong, in real terms, as to leave ‘the individual with no choice but to submit to what the statute required, though it did not command it.’ Aickin J confirmed that the words ‘but not so as to authorize any form of civil conscription’ were designed to impose an important limitation on legislative power, and that this limitation extends to practical as well as legal compulsion. His Honour pointed out that imposition by legislation of economic pressure that is difficult or unreasonable to resist

would be just as effective as legal compulsion, and would, like legal compulsion, be a form of civil conscription. To regard such practical compulsion as outside the restriction placed on this legislative power would be to turn what was obviously intended as a constitutional prohibition into an empty formula, a hollow mockery of its constitutional purpose.

Murphy J stated that practical compulsion, as distinct from legal compulsion, is enough to satisfy the concept of ‘civil conscription’ in s 51(xxiiiA), whereas Mason and Wilson JJ decided to leave this question open. Consequently, although not found to be relevant to the facts of General Practitioners, the concept of practical and economic compulsion as a form of civil conscription is still germane to the operation of the constitutional prohibition.

Nevertheless, following General Practitioners, the wider ambit of the power of the Commonwealth to regulate the way in which medical and dental services are performed was relied upon by the Commonwealth Government in 1995, when it enacted amendments to the National Health Act 1953 (Cth) and the Health Insurance Act 1973 (Cth). The question that needs to be posed is whether these initiatives are authorised by the power in s 51(xxiiiA) of the Commonwealth Constitution.

-

- VIII The Purchaser–Provider Agreements

The enactment of the Health Legislation (Private Insurance Reform) Amendment Act 1995 (Cth) enabled the introduction into Australia of what is commonly referred to as the ‘managed care’ system of health care. The ‘managed care’ system in Australia is built around the concept of ‘casemix’. In her second reading speech, Dr Lawrence, the then Minister for Human Services and Health, having announced that ‘casemix is the most significant Commonwealth health financing initiative developed in Australia’, went on to explain that:

The term ‘casemix’ means the types or mix of patients which a hospital treats, but can refer to a scientific approach to the classification of patient care episodes and ideas on how to use those classifications to help make decisions about health care.

Dr Lawrence’s definition of ‘casemix’ involves the regulation of medical practice. Moreover, the ‘casemix’ concept has provided the government and private health insurance companies with a tool for reconceptualising the notion of disease from a factor that adversely affects the health and the well-being of an individual into a commodity to be exploited for financial gain in the medical care marketplace. Once human ailments come to be regarded as commodities of trade and commerce, previously non-profit organisations such as health insurance funds, hospitals and other health care facilities (both public and private) are encouraged to make a profit. In fact, in 1998, the Coalition Government introduced amendments to the National Health Act 1953 (Cth), specifically designed ‘to remove obstacles to for-profit organizations applying for registration as health funds as well as making it easier for existing not-for-profit funds to become for-profit funds.’ Federal legislation which has laid foundations for this structural shift within the health care system has also affected the nature of the doctor–patient relationship.

The traditional patient–physician relationship, which Latham CJ referred to in BMA, is based upon the Hippocratic model which consists of three components — ‘the disease, the patient and the physician’. The professional relationship between the physician and the patient is strictly limited to the individuals concerned, with the subject matter of that relationship being the disease. A patient who is attended to by a private physician is considered to be in a contractual relationship with him or her. In the case of Breen v Williams, Brennan CJ noted that:

In the absence of a special contract between a doctor and a patient, the doctor undertakes by the contract between them to advise and treat the patient with reasonable skill and care. The consideration for the undertaking may be either a payment, or promise of payment, of reward or submission by the patient, or an undertaking by the patient to submit, to the treatment proposed.

The concept of ‘casemix’ is very closely connected to the ‘managed care’ system of health care, which is based on the principle of maximising profits through the economic efficiency of mass purchasing at a discount. The ‘managed care’ model, as presented by Dr Lawrence in the second reading speech, involves at least three parties to what formerly constituted a patient–physician relationship: the private insurance fund which acts as the ‘purchaser’ of health care services (referred to as ‘products’); the physician and other health care professionals, re-named ‘providers of the health care products’; and the patient, labelled ‘consumer’, who is the contributor to a private insurance fund. Thus, the Australian ‘managed care’ model is conceived of as a series of commercial transactions based upon a pre-determined price for products that the ultimate recipient — the consumer — has contracted for with the private health insurance fund. By virtue of s 73BD of the National Health Act 1953 (Cth), private health insurance funds can enter into purchaser–provider agreements with hospitals and day care facilities that enable them to purchase, in bulk, casemix health products for their members. Under the agreements, the respective health insurers make payments directly to the private hospitals ‘in full satisfaction of any amount that would otherwise be owed by the patient’. These agreements involve:

the contract between the ‘consumer’/patient and the insurance fund for the purchase of agreed ‘health care products’ in the form of designated casemix episodes of hospital treatment; and

the purchase of agreed ‘health care products’, designated casemix episodes of hospital treatment in bulk from hospitals which are a party to a purchaser–provider agreement.

That agreement involves:

the undertaking by the contracted hospital to provide the specified ‘health care product’ to the consumer; and

the payment by the insurance fund to the hospital for the ‘health care product’ to be provided to the consumer. However, the payment will only be made after the insurance fund has ascertained whether the contemplated ‘health care product’ falls within the category purchased by the consumer.

In return, the hospitals agree

to accept payment by the organization [the insurance fund] in satisfaction of the amount that would, apart from the agreement, be owed to the hospital or day hospital facility, in relation to an episode of hospital treatment, by an eligible contributor.

These agreements are independent of and separate from any agreements that physicians may enter into with the private insurance funds, such as those under s 73BDA of the National Health Act 1953 (Cth).

This provision allows registered health insurance funds to negotiate agreements with individual medical practitioners regarding the price payable by the funds for professional services rendered by contracted physicians to fund members. The agreements under s 73BDA(1)(a) and (b), respectively, include the acceptance by individual medical practitioners of

‘the payment by the organization [private insurance fund] in satisfaction of any amount that would, apart from the agreement, be owed to the medical practitioner, in relation to a professional service, by an eligible contributor’; and

the agreement by the fund ‘to accept assignments under s 20A(2A) of the Health Insurance Act 1973 of Medicare benefits payable in respect of the professional service.’ Under the assignment agreement, patients do not pay fees for services rendered by contracted physicians to the physicians, instead, 75 per cent of the Medicare benefits are transferred directly to the health funds.

Section 73BDA(2)(c) of the National Health Act 1953 (Cth), which is to be read together with s 73BDA(5), specifies that under the agreement between the fund and the practitioner, the physician is required to inform the eligible contributor at any time before the professional service is rendered, or as soon as circumstances permit after a professional service is rendered, of any amounts that she or he will be liable to pay. By virtue of s 73BDA(2)(d) the agreement must also ‘require the organization to maintain the medical practitioner’s professional freedom, within the scope of accepted practice, to identify appropriate treatments in the rendering of professional services to which the agreement applies’.

Section 73BDAA of the National Health Act 1953 (Cth) is similar in nature to s 73BDA, but it relates to purchaser–provider agreements between hospitals and physicians. It provides for hospitals to act as purchasers of professional services from doctors, with the hospital making payments directly to the practitioner ‘in full satisfaction of any amount that would otherwise be owed by the patient’. The Hospital Purchaser Provider Agreement between the hospital and the relevant insurer under s 73BD may then provide for the payment of medical practitioner fees by the health insurer to the hospital. Like s 73BDA, s 73BDAA specifies that under the agreement between the fund and the practitioner, the physician is required to inform the eligible contributor at any time before the professional service is rendered, or as soon as circumstances permit after a professional service is rendered, of any amounts that she or he will be liable to pay. Section 73BDAA(1)(d) also states that

the practitioner agreement requires the hospital or day facility to maintain the medical practitioner’s professional freedom, within the scope of accepted practice, to identify appropriate treatments in the rendering of professional services to which the agreement applies[.]

In her second reading speech, the Minister claimed that contracted physicians ‘will still be able to receive fee for service’. However, the legislation has effectively introduced an interloper in the form of the health insurance fund into the very essence of the physician–patient relationship. Under the assignment agreements provided for by ss 73BDA and 73BDAA, 75 per cent of the Commonwealth Medicare benefits payable as fees for services rendered by contracted physicians to patients are directly transferred to the insurance funds or hospitals, not to the physician. Indeed, schedule 8 provides for a system whereby health insurers and hospitals can become ‘approved billing agents’, thus entitling them to take an assignment of the Medicare benefit that the patient would have otherwise received in respect of a professional medical service provided to the patient by a practitioner. Thus, health insurers and hospitals are responsible for payment of the full amount of the practitioner’s fees as determined in accordance with an agreement between them and the practitioner. Consequently, the physician who enters such an agreement is a party to a contractual relationship not with the patient but with the insurance fund or hospital. It is arguable, therefore, that the purchaser–provider agreements under the National Health Act 1953 (Cth) are incompatible with the ‘fee for service’ model of private practice.

The fact that under the managed care system, the contracted physician has a contractual relationship solely with the insurance fund or the hospital rather than with the patient, is emphasised by the requirement that physicians inform the patients about the costs of services to be rendered before undertaking treatment. This requirement turns traditional clinical medical practice on its head. Ethical tradition going back to the Hippocratic Corpus enjoined doctors not to charge fees before the cure. The reasons were both medical and ethical. It was already well-known in ancient Greece that the patient’s psychological state is vital to the outcome of the therapy and, as the author of Precepts pointed out, worry over a fee may reduce the patient’s chances of successfully undergoing the treatment. More importantly, the insurance company requires notification before any treatment is undertaken in order to enable it to ascertain whether the patient has insurance cover for it, and if so, at what level. This concern is not alleviated by s 73BDAA(1)(d), which can be read in two ways. The first interpretation suggests that the legislation requires hospitals and day facilities to do nothing that would prevent contracted doctors from sorting out and classifying ‘appropriate treatments’ in the performance of their professional duties. As such, the provision amounts to no more than a commendable but ineffectual ‘motherhood’ statement.

Alternatively, the provision can be construed as prohibiting hospitals and day facilities from pressuring contracted doctors to conceal from patients appropriate but expensive services — such practice would amount to both negligence and misleading and deceptive conduct in breach of s 52 of the Trade Practices Act 1974 (Cth) (‘TPA’) on the part of these organisations. In either case, despite the reference to ‘professional freedom’, there is no indication in the language of this provision that hospitals and day facilities are required to allow the identified ‘appropriate treatment’ to actually be carried out. This suggests that, in the event of inadequate insurance or no insurance for a particular medical condition, having identified the ‘appropriate treatments’, the patient and the medical attendant have to make health care choices not on the basis of what is therapeutically the most efficacious and, often, the least toxic therapy for the relevant medical condition, disease or illness, but on the basis of what, in the final analysis, the insurance fund or the contracted hospital considers that the patient can afford. If the legislators were earnest about safeguarding the professional autonomy of medical practitioners and the best interests of patients, the provision would have required insurance funds and contracted hospitals to actually provide reasonable treatment once it is identified by doctors as ‘appropriate’ in the circumstances. Reference to treatment having to be reasonable in the circumstances would acknowledge the fact that the choice of treatment is to a certain extent predicated on its financial ramifications. In most cases, reasonable treatment will be treatment that can be justified in terms of efficacy, toxicity and costs. However, the development of clinical medicine will be stifled if no ‘appropriate’ treatments for a given condition are allowed by the private sector on the grounds that they are too experimental and too costly, even if the proposed therapy is the most reasonable one for the particular patient.

Furthermore, by prohibiting contracted medical practitioners from carrying on private practice in what was formerly the normal way, that is, by billing the patient after the service has been rendered, the new law compels them to carry on practice in a different way; it imposes upon relevant medical practitioners a shaman-like obligation to diagnose and predict the course of their patients’ condition, disease or illness before undertaking treatment. From a legal point of view, the requirement presupposes that the decision as to whether and what kind of treatment should be undertaken or continued will not be made by the two parties to the doctor–patient relationship, but rather treatment advice should be determined in accordance with what the patient-contributor can afford under the particular insurance policy. This requirement goes far beyond the regulation of merely administrative or financial aspects of medical private practice, and strikes at the core of the therapeutic relationship. However, if the High Court follows its reasoning in Alexandra, the requirement of billing the patient before the service is rendered may be considered as incidental, and consequently within the power of Federal Parliament.

The new managed care model of medical practice, based on a tripartite relationship between the contracted physician, insurance fund and patient-contributor is further entrenched by the 1995 amendments to the National Health Act 1953 (Cth), which nullify the principle of the patient’s privilege to confidentiality of medical information. It has been recognised by law that the medical practitioner’s ethical duty of confidentiality is pivotal to the patient–doctor relationship. The interest in maintaining professional duties of medical confidence, originally embodied in the Hippocratic Oath, is today regarded as an important public interest based upon the principle that it is in the interest of public health to encourage patients to truthfully disclose personal information without fear of embarrassment, stigma or incrimination that such disclosure may otherwise generate. The professional duty of confidentiality can be enforced through the law of equity, the common law, professional codes of ethics and statutory provisions in a number of Australian States and Territories. Typically, these statutes preclude health service providers from giving any identifying information, where this information has been acquired by reason of such a person being a public hospital staff member, if the patient could be identified in any way from the information. Yet, under s 23EA(3A)(a) of the Health Insurance Act 1973 (Cth), a declared private hospital must provide data specified in the Hospital Casemix Protocol in a patient identifiable state, to a registered private health insurance organisation which has an applicable agreement with the patient. The required information includes clinical notes, because under s 73BD of the National Health Act 1953 (Cth), the relevant hospitals are required to provide ‘all reasonable assistance’ to the health insurance funds to enable the funds to verify:

(i) essential variables for accurate casemix assignment; and

(ii) the payability of amounts by the organization under the agreement; and

(iii) the payability of other amounts by the organization relating to professional services rendered in connection with the hospital treatment.

However, as the then Minister for Human Services and Health pointed out in the second reading speech, a condition of agreements between the health funds and hospitals is the requirement that they ‘submit a single account covering all service and facility components and provide data for modelling, evaluation and research purposes’. Consequently, under s 73AB(4), there is a two-step ‘information relay’. First, a hospital or a day hospital facility under a hospital purchaser–provider agreement provides information to the relevant registered health insurance fund about each patient-contributor who was discharged by the facility during each period of one calendar month. Then, the health insurance organisations supply this information in a patient de-identified state to the Health Department and the Private Health Insurance Administrative Council. Although not expressly stated, contracted hospitals or hospital day facilities, if they are going to be paid, must provide patient-identified information about the condition and treatment of each patient-contributor to his or her health insurance fund. It should be noted that clinical information about the privately insured patients can be disclosed by the relevant hospitals to private insurance funds irrespective of whether the treating physicians are contracted to the funds, and without having to inform, let alone obtain consent to disclosure from, patients–contributors. It is to provide immunity from action for breach of the professional duty of confidentiality that s 73G of the National Health Act 1953 (Cth) was enacted. It provides that

(2) No action (whether criminal or civil) lies against a hospital or a day hospital facility, or a person acting on behalf of a hospital or a day hospital facility, for a breach of confidence, or breach of similar obligation, in relation to the disclosure of information if the disclosure is reasonably necessary in connection with:

(a) making a payment under an applicable benefits arrangement or assessing whether or not to make such payment; or

(b) any other matter relating to the operation of an applicable benefits arrangement.

(3) This section has effect despite:

(a) any law (whether written or unwritten) of the Commonwealth, a State or a Territory; and

(b) any contract, arrangement or understanding;

to the contrary.

The amendments might have been enacted under the ubiquitous incidental power under s 51(xxxix) and applied to the scheme providing for Commonwealth benefits under s 51(xxiiiA). Moreover, in the case of New South Wales v Commonwealth, the majority of the High Court of Australia held that the power with respect to insurance under s 51(xiv) gave the Commonwealth power to control and regulate the relationship between registered health benefits organisations and their contributors. Thus, ss 51(xxxix) and 51(xiv) would have given the Commonwealth the power to comprehensively nullify the patient-contributor’s rights to medical confidentiality vis-à-vis their private benefit organisations under s 73G of the National Health Act 1953 (Cth). Nevertheless, s 73G, when read together with ss 73BDA and 73BDAA, strengthens the argument that these amendments have the effect of substantially interfering with the therapeutic patient–doctor relationship.

-

- IX Australian Competition and Consumer Commission

The notions of a global marketplace and the associated ideology of economic rationalism have as their chief tenet financial competitiveness premised on freedom of market forces, which are supposed to minimise the cost of providing medical care. The idea that governments must ensure through regulation that competition extends to all persons engaged in any activity which involves the provision of services reached its apotheosis in the work of the National Competition Policy Review Committee, chaired by Professor Hilmer. The Committee was established in 1992, with the support of the Council of Australian Governments. Following the completion of the Hilmer Committee’s report, the TPA was amended by the enactment of the Competition Policy Reform Act 1995 (Cth), which became Part IV of the TPA. Under the federal distribution of powers, the two most relevant Commonwealth heads of power, namely ss 51(i) and 51(xx), did not expressly extend to regulation of the conduct of unincorporated businesses engaged in intra-state trade. This possible constitutional limitation, contained in s 51(i), was overcome by three intergovernmental agreements: the Conduct Code Agreement, the Competition Principles Agreement, and the Agreement to Implement National Competition Policy. The Competition Code Agreement was inserted as a schedule into the TPA. The Competition Code now contains the rules set out in Part IV of the TPA. However, they refer to ‘persons’ rather than ‘corporations’. Under the Competition Principles Agreement, States and Territories have enacted identical complementary legislation, whereby each is responsible for its own jurisdiction, while still enabling the Competition Code to be operative throughout all Australian jurisdictions.

Conduct prohibited under Part IV of the TPA includes, inter alia, exclusive dealing. The offence of exclusive dealing is broadly defined under the Act as involving one person who trades with or provides services to another imposing restrictions on the other’s freedom to choose with whom, or in what, to deal. While it is possible to obtain exemption in relation to general conduct involving exclusive dealing, a form of exclusive dealing known as ‘third line forcing’ is prohibited outright by the Act. The absolute liability offence of ‘third line forcing’ involves the supply of services on condition that the purchaser acquire goods or services from a particular third party or a refusal to supply because the purchaser will not agree to that condition. Pecuniary penalties for a breach of Part IV of the TPA provide for up to $10 million for companies and $500,000 for individuals. Apart from statutory penalties, ss 82 and 87 of the TPA provide for recovery of damages by any person who has suffered (or, in the case of s 87, is likely to suffer) loss or damage ‘by conduct of another person’ which contravenes Part IV, (or engaged in conduct that is ‘unconscionable within the meaning of the unwritten law, from time to time, of the States and Territories’ contrary to s 51AA).